Separate Property Tracing Subtleties

June 27, 2022

Nancy Hetrick, CDFA®, MAFF®, AWMA®

Divorce Work Teaches Something New on EVERY Case!

I was hired by an attorney and client, Husband, to review and rebut a Separate Property Tracing done for the Wife’s retirement plans. As I reviewed it and all the corresponding statements going back to 2010, it was immediately apparent that many statements were missing and not provided.

In general, the tracing the other firm had done was top-notch. Used the same methodology I use for the most part and had a very professional summary report to present. I pointed out all the missing statements, GOT THEM, and updated the numbers accordingly. They then did the same.

And we got different results. Theirs, of course, favored their client, and mine favored mine.

This firm’s reports, in my opinion, were total overkill on information BUT it gave me the opportunity to learn! This firm has been around for decades and is filled with Forensic Accountants and Pension Evaluators.

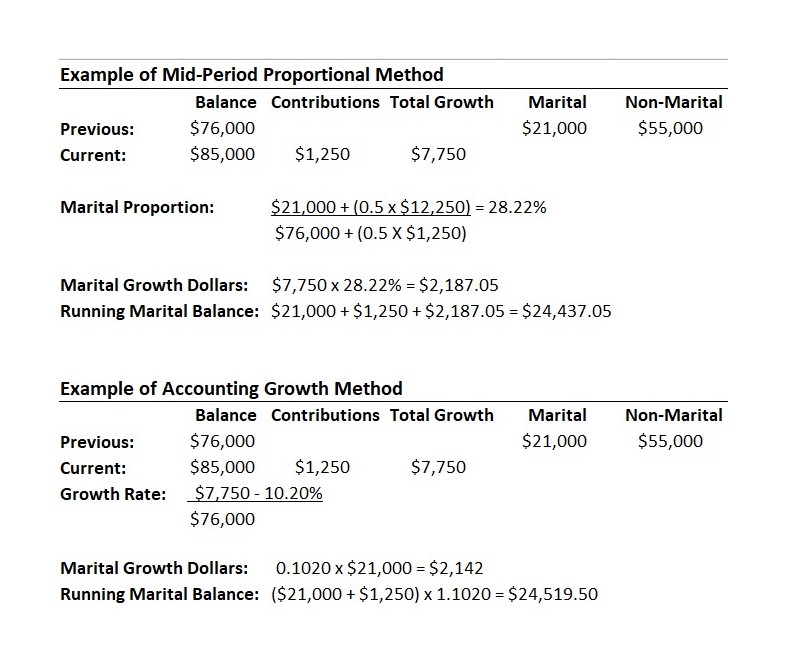

At the end of this blog is the exact copy but long story short, there are two recognized methods to calculate the growth on an annual basis. The Mid-Period Proportional Method and the Accounting Growth Method. One assumes the net activity all happened at the Mid-Point of the year. The other method is the Accounting Growth Method. It assumes the Net Activity happens on the 1st day of the Period.

The document explains each in detail and even gives the exact calculation formulas and an example.

As I read it through, it was clear that either method would be valid and depending on who is your client, you would select the one that favored them and HOPE that the other side doesn’t have an expert that knows the difference, which would be the case most of the time.

You don’t have to come in knowing it all. Just pick it up as you go, case by case by case.

Like this stuff? This is the more advanced CDFA work. If you want to be able to work at this level, seriously consider joining us in Velocity. That’s where we go DEEP!!!

Mid-Period Proportional Method

In this method, the growth is calculated for the total account for each period and apportioned to the marital and non-marital property based on the relative proportion of each piece to the total account. These relative proportions are calculated assuming uniform activity throughout that period; this is equivalent to assuming that all activity occurs in the middle of the period. The total growth is apportioned based on the allocation of the marital and non-marital assets as of the middle of the current period.

The total growth for any period is calculated by subtracting the ending balance from the beginning balance, then subtracting all money going into the account and adding back in money coming out of the account for that period. This is the increase in the account due to change in asset value, interest, and dividends as distinguished from changes related to initiatives by the participant, in other words, the passive growth of the account. All additions or subtractions not relating to the experience of the assets contributions, loans, loan payments, withdrawals, etc., which are initiated by the participant are considered as the activity and are determined to be either marital or non-marital in nature, in part or in total. Fees are considered as part of the experience/passive growth of the asset holdings.

The marital calculation begins with the determination of the ending marital balance from the previous period. Half of the net marital activity for the current period is then added. Divide that number by the ending total account balance from the previous period plus half of the net total activity for the current period. Therefore, this proportion represents the percentage of the account that is marital at the mid-point of the period. Multiplying the total dollars of growth by this percentage, representing the marital component of the account, provides the dollars of marital growth to be allotted to the marital running balance.

The same calculations are made regarding non-marital assets. Based on the assumptions, this generates accurate marital and non-marital balances as of any end-of-period date. However, they are balances as of that specific date, only, and not as of the end of the period of the most recent statement,

Please refer to the example later in this section.

Accounting Growth Method

In this method, the growth is calculated for the total account for each period and expressed then as a growth percentage for the total account. This growth percentage is then applied to the preceding marital and non-marital balance and activity. This method assumes that the net activity for each period occurs on the first day of the period.

The total growth for any period is calculated by subtracting the ending balance from the beginning balance, then subtracting money going into the account and adding back in all money coming out of the account for that period. This is the increase in the account due to change in asset value, interest, and dividends, as distinguished from changes related to initiatives by the participant, in other words, the passive growth of the account. All additions or subtractions not relating to experience of the assets contributions, loans, loan payments, withdrawals, etc., which are initiated by the participant are considered as the activity and are determined to be either marital or non-marital in name, in part, or in total. Fees are considered as part of the experience/passive growth of the asset holdings.

The marital calculation begins with the determination of the ending marital balance from the previous period. The net marital activity for the current period is then added. These marital assets are then multiplied by the growth percentage and tracked as a running number representing the marital component of the account.

The same calculations are made regarding non-marital assets. This generates approximate marital and non-marital balances as of any end-of-period date. However, the running allotted values do not represent the actual apportioned values due to rounding and the weighting of the activity versus the timing of the actual event. Because we are multiplying two, sometimes rather large, balances by a growth rate, usually the marital and non-marital balances do not sum up to the exact account balance. As a result, the balances must be adjusted, via a proportion, up or down to yield the true result of the analysis. Therefore, based on the assumptions, the stated allocation is valid only for the date of the adjustment; the values in the calculation history are tentative pending the final adjustment.

Example of Mid-Period Proportional Method:

Join us for Business Blastoff to start learning the disciplines that will GUARANTEE this year is different. There’s a virtual option and a money-back guarantee. Be stronger than your excuses.

Register for Business Blastoff HERE | Register for Velocity HERE

Want new articles before they get published?

Subscribe to our Awesome Newsletter.

#1 trusted source for information & courses that will ensure your success as a Divorce Financial Planner.

Two Day workshop for Divorce Financial Planners to design your divorce niche & complete your roadmap to success!

Step-by-Step 12 month program for CDFA® holders who want to grow & sustain a profitable business.

Self-paced journey for successful professionals who seek the essential knowledge needed as a CDFA®.